PMX converts paper bill pay checks into electronic ACH, getting you paid faster while saving you time and money.

“By having PMX convert payments to electronic ACH, we have reduced the number of hours it takes our team members to post such payments, saving us time and money. Utilizing PMX is a decision your organization will not regret.”

“My experience with PMX has been excellent! We have been able to reduce the number of paper checks by over 2,000 in a few short months.”

“Within one month of using PMX, we decreased our paper check payment processing by more than 90 percent. It has been an outstanding solution for us.”

“Switching to PMX has taken a task that required several hours each day and transformed it into a 15-minute event.”

How PMX Works

Registration

PMX registers you as an electronic receiver with all of the top consumer bill pay originators, enabling paper checks to be converted to electronic instructions and ACH.

Conversion

Based on your electronic profile, the originators will convert the related bill pay payment from paper to electronic, vastly improving the speed at which these payments get posted.

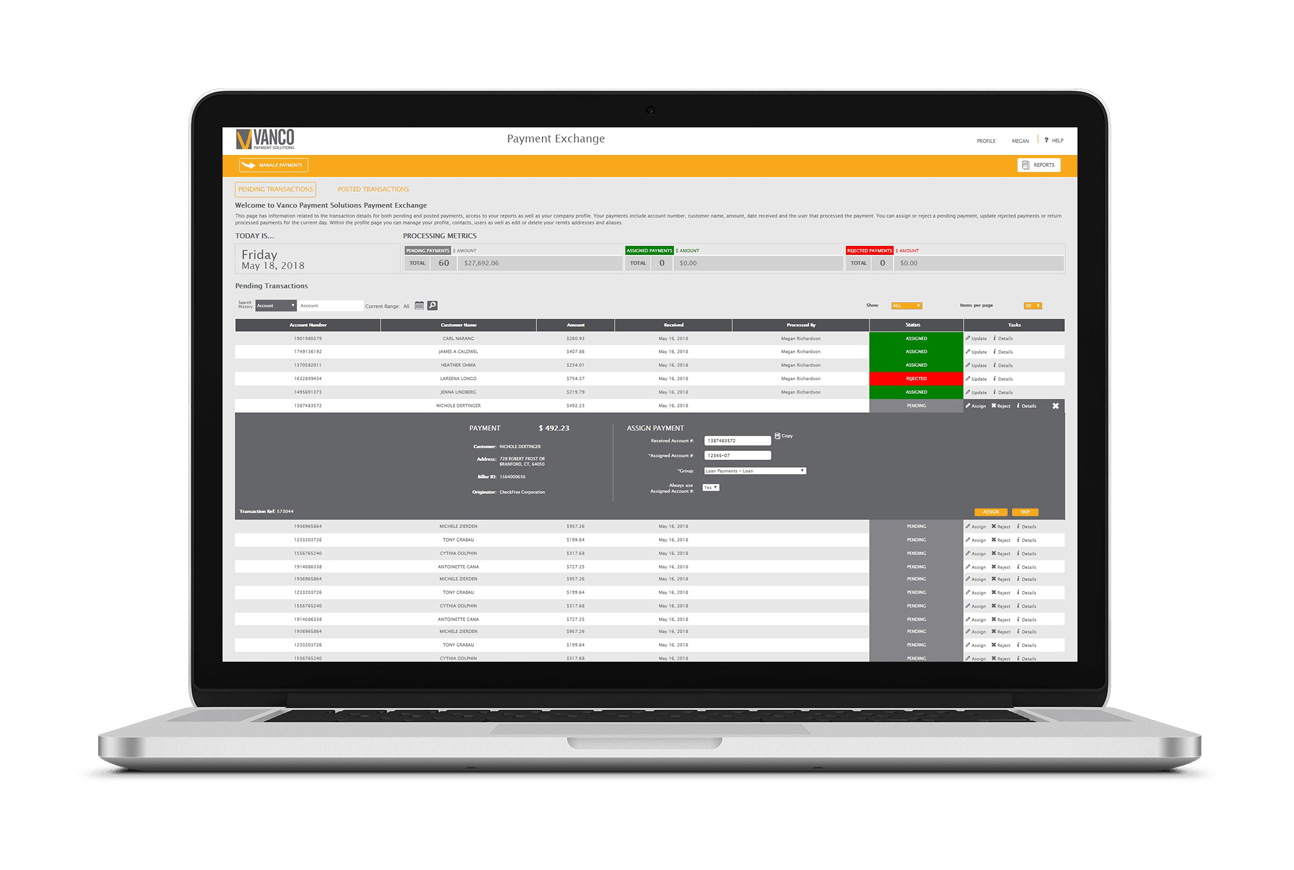

Pre-Processing

PMX separates payments. The known payments are automatically assigned for delivery while incorrect and new items are presented for a one-time review, lowering operational expense and saving your employees valuable time.

Automated Settlement

Settlement is sent daily via ACH credit, direct to your account. You receive the money 5 to 10 business days faster than with paper checks, reducing the number of customer service calls related to payment status and disputes.

Why Clients Trust PMX?

- Receive your money 5 to 7 business days faster than with paper checks

- Lower operational expenses, saving 10 employee hours per month for every 1,000 checks converted

- Reduce support calls related to consumer payment status and late payment fee disputes

- Improve exception handling by electronically rejecting or returning payments

- No integration or lengthy projects required. Up and running in 3 to 5 business days